The Biggest Cap Rate Misconception on the Planet! Part 3 of 3

Comments are closed

Posted by John Simpson

So in Part 1 I poked holes in the old axiom that the cap rate is a return of investment. In Part 2 I mathematically proved that the difference between two cap rates for the same property (or extremely comparable properties) is appreciation… yet we also went on to show that the timing between two is all wrong. An 8 percent cap rate plus 2 percent appreciation does not equal a 10 percent cap rate unless the 10 percent cap rate shows no appreciation and one property appreciates at 2 percent and the other does not. I’d say that you can drive a truck through that hole.

So now let’s get to the real show stopper – the commonly used benchmark that the cap rate is a return of investment. Using the example given to us by Wikipedia, a 10 percent cap rate has a 2 percent higher return on investment than an 8 percent cap rate. Let’s put it to the empirical mathematics test.

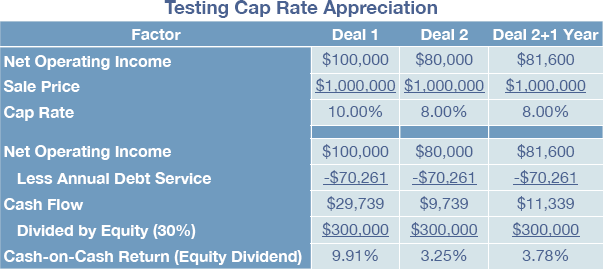

Remember our little table called Testing Cap Rate Appreciation? Let’s reproduce it here since I’ll be referencing so heavily and let’s add an additional line item.

Using our example, way too many people believe that they would get an extra 2 percent if they could buy our fictional property at a 10 percent cap rather than 8 percent. Simple cap rate math, right? Well, take a look at the cash-on-cash line for each of these two cap rates. The 10 percent cap gets a 9.91 percent return and the 8 percent cap gets a 3.25 percent return. That’s not a 2 percent difference – it’s a 6.66 percent difference. Subtract the 2 percent return differential that appraisal theory and much of the market believe is the true rate of return and you have a 4.66 percent net difference! How can that be?

The reason is financing. Both of these properties get the same financing (70 percent loan-to-value ratio, 20 year loan amortization and 8 percent interest), so the mortgage payment is $70,261 using my trusty financial calculator. What’s left after you deduct debt service from net operating income is cash flow… and when you divide cash flow by your cash equity in the deal (your 30 percent down payment), you see the results. This means that if you bought the property at a 10 percent cap, you’d get 4.66 percent more return than at an 8 percent cap! The explanation for this is simple. The cap rate is not a true and complete indicator of return on investment any more than two wheels are a bike. You need to take it one line further and subtract debt service to get cash flow. Without cash flow you can’t calculate your return on equity.

The Effect of Financing

In the example used, the financing was the same. In the real world it isn’t always this way. Bankers have a little tool at their disposal called the debt coverage ratio. Here’s how it’s defined and explained in further detail:

The debt service coverage ratio (DSCR), is the ratio of cash available for debt servicing to interest, principal and lease payments. It is a popular benchmark used in the measurement of an entity’s (person or corporation) ability to produce enough cash to cover its debt (including lease) payments. The higher this ratio is, the easier it is to obtain a loan. The phrase is also used in commercial banking and may be expressed as a minimum ratio that is acceptable to a lender; it may be a loan condition or covenant. Breaching a DSCR covenant can, in some circumstances, be an act of default.

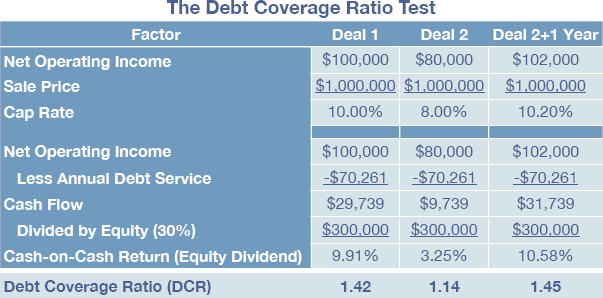

So let’s say you go into the office of your friendly neighborhood banker and you have two deals to choose from – one with an 8 percent cap rate and the other with a 10 percent cap rate. You’d like him to finance the acquisition and you ask him how much the mortgage would be. The banker says he’s lending at, say, a 1.3 debt coverage ratio. That means that you need to have a net operating income that is 30 percent higher than the mortgage amount (the 0.3 part of 1.3). As shown in the table that follows, under the 10 percent cap rate deal, you easily make the 1.3 DCR with a nice, hefty 1.42 DCR. You smile.

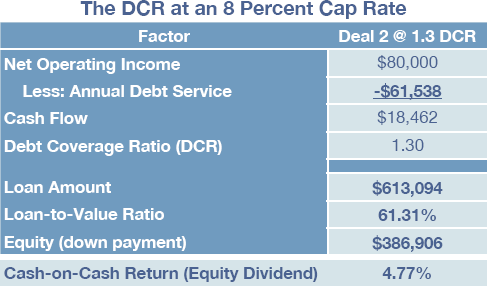

Now let’s say that you went in with the same deal but at an 8 percent cap rate. You sit in the same chair. You’re all ready to smile. Then your lender says to you that you fall short of the DCR they need to make you the loan. They need you to put more of a down payment into the deal. You start to squirm in that nice, comfy chair. It seems a bit hot – maybe the air conditioning is on the fritz. So you ask the lender based on your 8 percent cap rate deal how much they would lend? As shown below, to do the deal, the loan-to-value ratio has dropped from 70 percent to 61.31 percent. Who moved your cheese? You’ve got to come up with an additional $87,000 down payment!

Regardless of how easily you can write an $87,000 check (please send it to me Fed Ex:), the loan terms have changed due to the cap rate difference and the inability to carry the loan at the lender’s required minimum acceptable level. And that’s the point. We all like simple phrases that are 100 percent true, but to be so everything else must be ceteris parabus. Unfortunately, the real world is not like that. Not everything stays the same between an 8 percent cap rate deal and a 10 percent cap rate deal. Financing can change everything. Oh, by the way… the 61.31 percent loan-to-value ratio raises the cash on cash return from 3.25 percent to 4.77 percent, but that’s still way less than the 9.91 percent cash-on-cash return from the 10 percent cap rate deal.

Can you guess why the return goes up? Let’s make it an open book test. If we run the same calculation using our original debt service, $70,261, we’re able to apply it to the mathematical proof of this hyperlinked article and the result is that the break point between positive and negative leverage is 11.34 percent. So, since both the 10 percent and 8 percent cap rates are below 11.34 percent, they are negative leverage investment vehicles. Just as you would expect, the less you mortgage, the higher your return on investment. This is exactly what we see with the increase in the cash-on-cash return from 3.25 to 4.77 percent that results from the extra $87,000 down payment.

Of course it’s entirely possible that the additional $87,000 down payment is a deal breaker.

Cap Rate Return on Investment Conclusion

We’ve shown and proved the following differences between an 8 percent cap rate and a 10 percent cap rate for the same property:

- The 2 percent difference in the cap rate results not in an additional 2 percent return but an additional 6.67 percent return.

- The lower cap rate deal has, naturally, less cash flow. As a result, the debt coverage ratio lender criterion is not met. The result would be that the lender would lend you less on the 8 percent cap rate deal, so the simple reality is that financing would be different. The down payment would be greater and it would also increase the cash-on-cash return.

- The extra down payment might be a deal breaker… especially considering that you’d still have to put $300,00o (30 percent) down.

Let’s flip this around. What this means is that getting a property at a 10 percent cap rate compared to the same property at an 8 percent cap rate results in the following:

- A return on investment greater than the 2 percent cap rate difference.

- A return on investment that will always be greater than that present in a lower cap rate deal regardless of financing terms (unless the point of neutral leverage is between the two cap rates).

- A strong probability that you’ll meet the debt coverage ratio of the lender and be able to use the loan terms he/she gave you to calculate an accurate cash-on-cash return.

- A low probability that the lender will ask you for more down payment.

These are the reasons why investors want higher cap rates. Of course that doesn’t mean that they can get them! If a seller wants to sell at an 8 percent cap rate and the investor wants to buy at a 10 percent cap rate, there’s a good chance there’s an irreconcilable difference there. Maybe the seller is leveraged to the point where they can’t sell the property at a 1o percent cap rate and pay off their loan balance. Maybe they feel their sweat equity is evaporating.

What’s the net effect? Investors move to higher yield properties… those with higher cap rates when there are sufficient numbers of them. Even if there is little or no financing available, the cost of capital for an illiquid asset requires a high rate of return. Ladies and gentlemen… that’s today’s entire real estate market in a nutshell. That’s why there is so little “meeting of the minds” out there and so few equity deals being done.