Could purchasing individual dockominiums be a good cash investment right now? Let’s try to exorcise my madness with a little math.

So with a simple phone call I get a list of dockominiums for-sale and for-lease. I’ll keep the marina name confidential but I will say that it’s in an area that has not shown a big crash in dockominium values. They’re pretty easy to get – just call the marina’s phone number in marinas.com and ask for the property manager or head of the dockominium association. They’ll be glad to fax you the information. Even though they might be individually owned, it makes sense to have the property manager offer them for sale, so in this respect most available for-sale or for-rent dockominiums are represented.

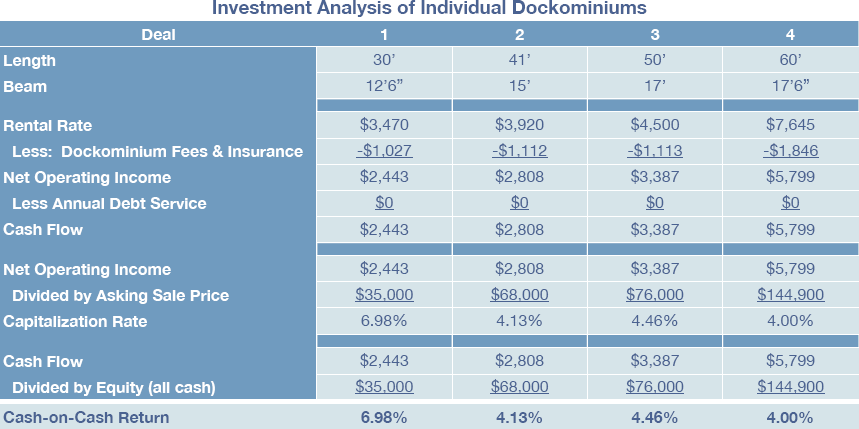

Although I have dozens to choose from, let’s pick four common slip size ranges and see where the numbers fall.

In the above I’m using asking sale prices, asking rental rates, actual dockominium association fees and actual insurance costs for each slip. The results are kind of strange. At first glance the eye goes to the cash on cash return (if I made it bold, there must have been a reason), which isn’t bad considering that they’re paying you almost nothing in a bank savings account. That’s the good news… and I’m fresh out of that.

The bad news is that the cap rate is the cash on cash return because I’m assuming there is no financing. This is certainly a very real assumption in today’s market. Those cap rates are really low! Still this is a management-less investment. Interestingly, the best cash on cash return is with the smallest dock.